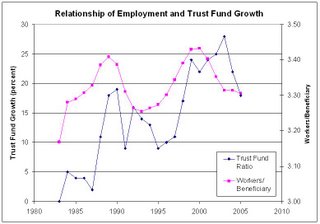

Employment Drives Trust Fund Growth?

.

.

.

.

.

.

I posted a comment at Economist's View that I believe employment is more critical than productivity to growth of the SS Trust Fund. When employment (as observed in the ratio of workers per beneficiary) changes, the growth of the trust fund appears to follow.